internet tax freedom act us code

See 47 United States Code Section 151. Ron Wyden D-Ore the law placed an initial year-long moratorium a legally authorized period of delay on special taxation of the Internet.

Gekas chairman of the subcommittee presiding.

. 151 note is amended to read as follows. 151 note is amended 1 in section 1101a by striking 2007 and inserting 2014 and 2 in section 1104a2A by striking 2007 and inserting 2014. 151 note is amended by striking during the period beginning.

The ban on taxing internet access has been around in some form since 1998 and Congress has extended the ban by increments several times. Congress voted to pass the legislation. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled SECTION 1.

105-277 1100-1104 112 Stat. 5 Internet Tax Freedom Act Pub. The Internet Tax Freedom Act ITFA Title XI of the Omnibus Appropriations Act of 1998 was approved as HR.

Internet Tax Freedom Acts prohibition against taxing internet access applies to all states beginning July 1 2020. Promote and preserve the commercial educational and informational potential. Since its initial enactment in 1998 the Internet Tax Freedom Act ITFA has banned federal state and local governments from taxing Internet access charges as well as from assessing multiple or discriminatory taxes on electronic commerce.

It extends the prohibitions against multiple and discriminatory taxes on electronic commerce until November 1 2014. Introduced more than a year earlier in March 1997 by Rep. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

Jun 17 1998. GRANDFATHERING OF STATES THAT TAX INTERNET ACCESS. GRANDFATHERING OF STATES THAT TAX INTERNET ACCESS.

1054 TAX FREEDOM ACT July 17 199 Serial No. The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL. Congress passed a permanent version of the Internet Tax Freedom Act ITFA and President Obama has now signed it into lawITFA bans state taxes on internet access.

The Internet Tax Freedom Act HR. INTERNET TAX FREEDOM ACT THURSDAY JULY 17 1997 House of Representatives Subcommittee on Commercial And Administrative Law Committee on the Judiciary Washington DC. The Internet Tax Freedom Act ITFA enacted in 1998 was intended to protect the developing internet technology.

On July 1 2020 the Permanent Internet Tax. 151 note is amended by adding at the end the following. 25 LIBRARY 1998 Government Depository printed for the Of the Committee on the.

The subcommittee met pursuant to notice at 1001 am in room 2237 Rayburn House Office Building Hon. 105277 text on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet. 1 1998 when the US.

Christopher Cox R-Calif and Sen. The stated purpose of this law was to. Permanent moratorium on Internet access taxes and multiple and discriminatory taxes on electronic commerce.

MORATORIUM ON CERTAIN TAXES. This Act may be cited as the Permanent Internet Tax Freedom Act. The ITFA would institute a moratorium to preclude double taxation of electronic commerce and taxation that singles out the Internet for excise-type taxes.

A In general Section 1101 a of the Internet Tax Freedom Act 47 USC. ITFA prohibits Internet access taxes multiple taxation of a single transaction by more than on taxing jurisdiction and discriminatory taxes that do not apply to offline purchases. On February 11 the United States Senate approved a permanent extension of the Internet Tax Freedom Act ITFA which previously passed the House of Representatives on December 15 2015.

The Internet Tax Freedom Act 47 USC. Section 1104 of the Internet Tax Freedom Act 47 USC. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access.

151 note is amended 1 in section 1101a by striking 2007 and inserting 2014 and 2 in section 1104a2A by striking 2007 and inserting 2014. Considering the international local and national implications of the Internet Tax Freedom Act not to mention the legal costs entailed when the European Union state governments and municipalities take the US federal government to court legal costs to all involved governments regardless of who wins passing ITFA would be foolish. A AMENDMENT- Title 4 of the United States Code is amended by adding at the end the following.

Page 2 The term internet access means a service that enables users to access content information electronic mail or other services offered over the Internet and may also. Additionally ITFAs Grandfather Clause which allows certain states to continue to tax Internet access is phased out. The ban has not been permanent until now.

The Internet Tax Freedom Act was first enacted on Oct. 442 would call time-out on taxes that discriminate against electronic commerce and the Internet. Sections 1101a and 1104a2A of the Internet Tax Freedom Act title XI of division C of Public Law 105277.

ITFA which prohibited states and localities from applying taxes on internet access or imposing discriminatory digital-only taxes became permanent in 2016 but included a grandfather clause that allowed states with taxes existing before 1998 to keep that. To establish a national policy against State and local interference with interstate commerce on the Internet or online services and to excise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would interfere with the free flow of commerce via the Internet. 151 note shall be applied by substituting October 1 2016 for October 1 2015.

2 Section 110410 of the Internet Tax Freedom Act 47 USC. A for purposes of subsection a the term Internet access shall have the meaning given such term by section 1104 5. 10 TAX ON INTERNET ACCESS A IN GENERALThe term tax on Internet access means a tax on Internet access regardless of whether such tax is imposed on a provider of Internet access or.

The Internet Tax Freedom Act 47 USC. This Act may be cited as the Internet Tax Freedom Act. On November 1 2007 President Bush signed the Internet Tax Freedom Act Amendment Act of 2007 into law.

INTERNET FREEDOM ACT HEARING BEFORE SUBCOMMITTEE OX COMMERCIAL AND ADMINISTRATIVE LAW or THE COMMITTEE ON THE JUDICIARY HOUSE OF REPRESENTATIVES ONE HUNDRED FIFTH CONGRESS FIRST SESSION HR. 4328 by Congress on October 20 1998 and signed as Public Law 105-277 on October 21 1998.

If You Don T Have Nexus And Don T Charge Sales Tax Are You Liable If The Customer Does Not Pay The Tax Sales Tax Institute

Internet Privacy Overview And Legislation In The 109th Congress 1st Session Everycrsreport Com

The History Of Iana Internet Society

With Net Neutrality Back In Motion Is Federal Universal Service Fund Reform Next Cpa Practice Advisor

Cell Phone Tax Wireless Taxes Fees Tax Foundation

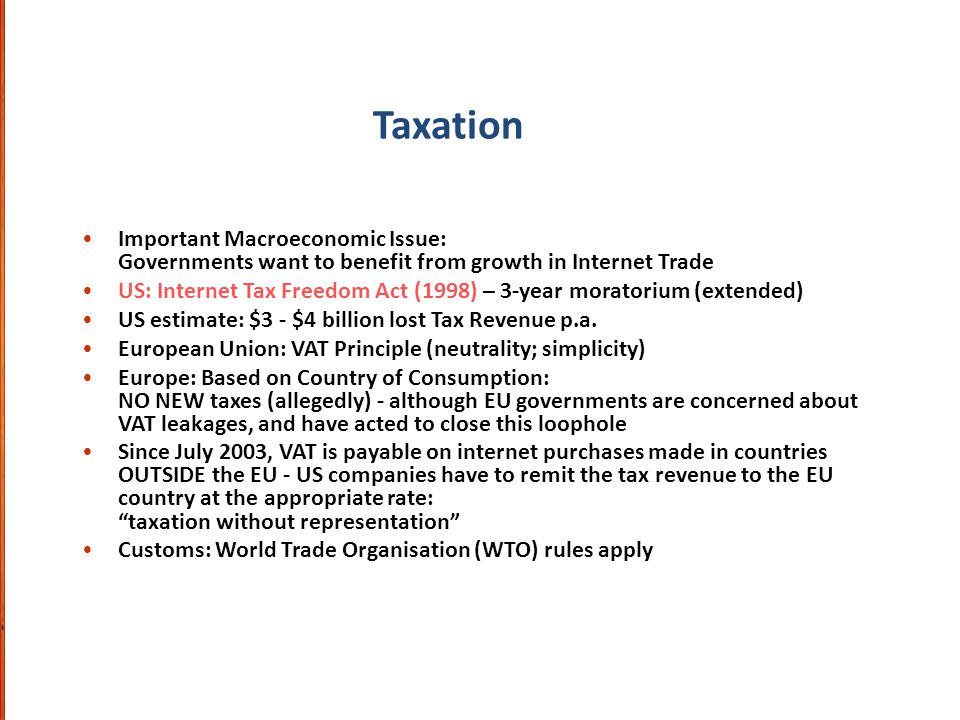

Ethical Legal And Public Policy Issues In E Business Ppt Download

Section 230 A Key Legal Shield For Facebook Google Is About To Change All Tech Considered Npr

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Taxes And Fees 2021 Tax Foundation

Internet Sales Tax Definition Taxedu Tax Foundation

The Irs Wants To Know About Your Crypto Transactions This Tax Season

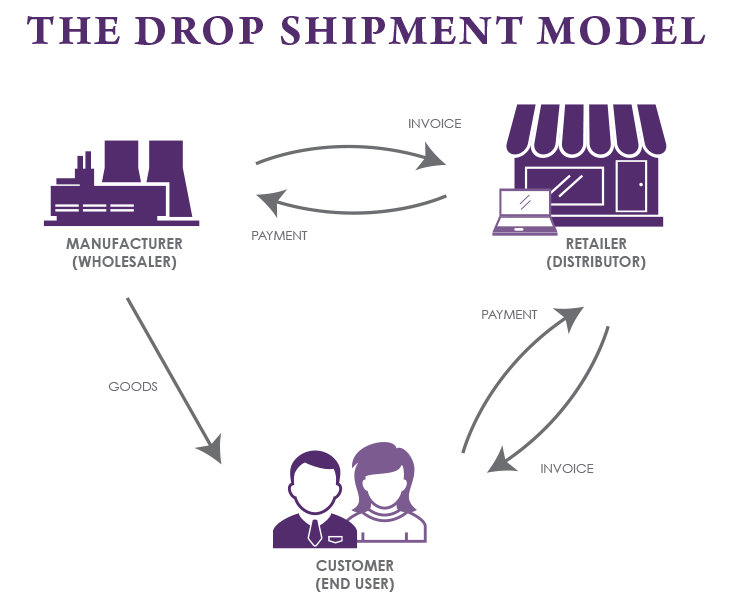

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

/cdn.vox-cdn.com/uploads/chorus_asset/file/13054499/mdoying_180915_1777_0001.jpg)

Europe S Controversial Overhaul Of Online Copyright Receives Final Approval The Verge

A Guide To Anti Misinformation Actions Around The World Poynter